Finding the right car finance in Manchester can be challenging, especially if you have a less-than-perfect credit history. Many people search for “no credit check car finance Manchester” hoping for a quick solution. While understanding this need, let’s explore the car financing landscape in Manchester and provide valuable information for potential car buyers.

Understanding Car Finance Options in Manchester

Car Finance Options in Manchester

Car Finance Options in Manchester

Navigating the world of car finance can feel overwhelming, but understanding your options is the first step. Several paths exist for financing a car in Manchester, each with its own set of advantages and disadvantages. These include traditional bank loans, dealer financing, and specialized lenders who may cater to individuals with bad credit for cars manchester.

Is “No Credit Check” Car Finance Realistic?

While the term “no credit check” is often used in advertisements, true “no credit check” car finance is rare. Most lenders, even those specializing in bad credit car finance, will still perform a credit check to assess your financial situation. However, they may place less emphasis on your credit score and consider other factors, like your income and employment history. For the best car finance manchester options, research thoroughly.

Tips for Securing Car Finance in Manchester with Bad Credit

Tips for Securing Car Finance with Bad Credit

Tips for Securing Car Finance with Bad Credit

Improving your credit score before applying for car finance can significantly increase your chances of approval and securing better terms. Even small improvements can make a difference. You can improve your score by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. Considering manchester financial advice can be beneficial in this situation.

What Documents Are Needed for Car Finance?

Typically, you will need proof of identity, proof of address, proof of income, and details of your banking history. Be prepared to provide these documents upfront to streamline the application process.

Exploring Alternatives to Traditional Car Finance

Alternatives to Traditional Car Finance in Manchester

Alternatives to Traditional Car Finance in Manchester

If you’re having difficulty securing traditional car finance, consider exploring alternatives. Leasing a car can be a more affordable option, and car subscription services are gaining popularity. You can also explore options like business asset finance manchester if applicable.

Conclusion: Finding the Right Car Finance in Manchester

While securing “no credit check car finance Manchester” might be difficult, there are numerous car financing options available in Manchester for individuals with varying credit histories. By understanding your options, preparing your finances, and researching lenders, you can increase your chances of finding the right car finance solution that fits your needs. Don’t forget to check manchester car finance reviews for insights and feedback from other car buyers in Manchester.

FAQ

- What is the average interest rate for car finance in Manchester?

- How can I check my credit score for free?

- What is the difference between hire purchase and personal contract purchase?

- What happens if I miss a car finance payment?

- Can I get car finance if I’m self-employed?

- How long does the car finance application process usually take?

- Can I pay off my car finance early?

Khi cần hỗ trợ hãy liên hệ Số Điện Thoại: 0372999996, Email: bong.da@gmail.com Hoặc đến địa chỉ: 236 Cầu Giấy, Hà Nội. Chúng tôi có đội ngũ chăm sóc khách hàng 24/7.

Máy Lọc Nước Điện Giải Các Loại

Máy Lọc Nước Điện Giải Các Loại Máy Lọc Nước Điện Giải Công Nghệ

Máy Lọc Nước Điện Giải Công Nghệ Lịch sử hình thành Manchester 17 MCC

Lịch sử hình thành Manchester 17 MCC Chọn resort Maldives cho chuyến đi từ Manchester

Chọn resort Maldives cho chuyến đi từ Manchester Hoạt động giải trí tại Maldives cho chuyến đi từ Manchester

Hoạt động giải trí tại Maldives cho chuyến đi từ Manchester Phân loại rác thải tại nhà ở Greater Manchester

Phân loại rác thải tại nhà ở Greater Manchester Cozy Bed and Breakfasts in Manchester Vermont

Cozy Bed and Breakfasts in Manchester Vermont Activities and Attractions in Manchester Vermont

Activities and Attractions in Manchester Vermont Tìm kiếm lớp học tiếng Pháp tại Manchester, NH

Tìm kiếm lớp học tiếng Pháp tại Manchester, NH Các tiêu chí lựa chọn lớp học tiếng Pháp

Các tiêu chí lựa chọn lớp học tiếng Pháp Lợi ích của việc học tiếng Pháp

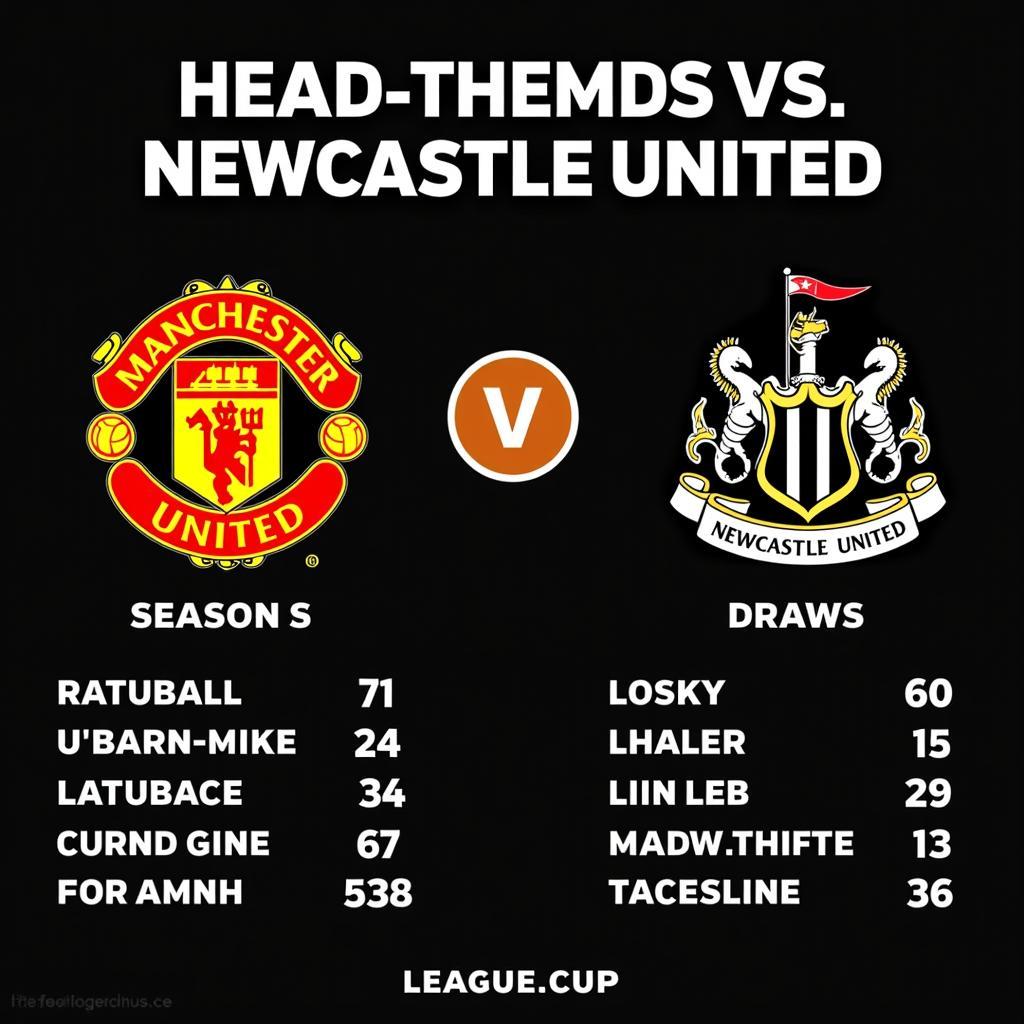

Lợi ích của việc học tiếng Pháp Manchester United vs Newcastle United: Đối đầu kịch tính

Manchester United vs Newcastle United: Đối đầu kịch tính Lịch sử đối đầu Manchester United vs Newcastle United qua các năm

Lịch sử đối đầu Manchester United vs Newcastle United qua các năm Tại sao giải bài tập toán tin lại quan trọng?

Tại sao giải bài tập toán tin lại quan trọng? Ví dụ minh họa giải bài tập toán tin

Ví dụ minh họa giải bài tập toán tin Lời khuyên để giải bài tập toán tin hiệu quả

Lời khuyên để giải bài tập toán tin hiệu quả